Few market signals convey as much information about the state of the global macro picture as movements in foreign exchange (FX) prices. This is particularly valid when it comes to deep, liquid FX markets of major currencies from advanced economies, such as the US Dollar (USD), the Euro (EUR), the Great British Pound (GBP), the Swiss Franc (CHF) and the Japanese Yen (JPY). FX is driven by capital flows, which correspond to real time reactions to expectations about risk appetite, relative economic performance and interest rate differentials.

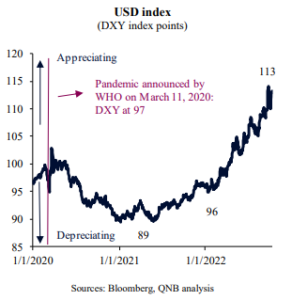

In recent months, the USD has appreciated against major currencies to levels not seen in decades. In fact, the USD index (DXY), a traditional benchmark that measures the value of the USD against a weighted basket of six major currencies, has appreciated by more than 16% from pre-pandemic levels, more than 17% year-to-date and more than 27% from the post-pandemic bottom in early 2021.

The USD move did not happen in a straight line. At the beginning of the pandemic, the USD was supported by significant “safe-haven” demand from global investors. However, shortly after this, in a matter of weeks, the USD depreciated against major currencies for around six months. This took place between May 2020 and January 2021, when the US provided faster and bigger policy stimulus than other economies. But the move more than fully reversed thereafter, leading to a deeper appreciation of the USD against all major currencies. This leads to the question: Is the USD overvalued?

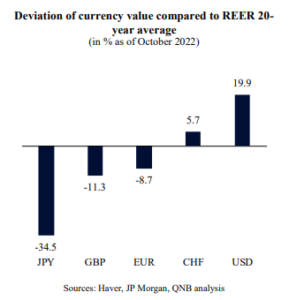

A common way to look at currency “valuations” is to analyse trade-weighted, inflation-adjusted exchange rates, i.e., the real effective exchange rates (REER), and compare it to their own long-term averages or historical norms. This REER metric is more robust than traditional FX rates as it captures changes in trade patterns between countries as well as economic imbalances in the form of inflation and inflation.

The CPI REER picture for October 2022 suggests that the USD is indeed overvalued by almost 20% over its 20-year average. In our view, the conditions are not set yet for a reversal of the USD strength. Three factors underpin our analysis.

First, risk appetite is expected to remain subdued on the back of a profusion of high and rising political, geopolitical as well as other tail risks that are threatening the global economic outlook. This includes the Russo-Ukrainian conflict, tensions in the Far East and financial stability concerns. With investor and consumer sentiment vulnerable to negative news, the USD becomes a “safe-haven” instrument against turbulence in Europe and Asia.

Second, the US growth outlook also looks stronger than the one from other major advanced economies. This is especially salient as the current geopolitical and energy crisis have a disproportionate impact on Europe and other major energy importers. Faster relative growth in the US tends to favour investments within the US, attracting capital from overseas. This supports the USD.

Third, expected real interest rates, which adjust the medium-term interest rate by forward-looking inflation metrics, are also set to move in a direction that favour the USD. This is not only due to the aggressive policy stance of the US Federal Reserve (Fed) but also because US inflation is likely to have peaked. In contrast, inflation expectations have been increasing in the Euro area and Japan, where central banks are much more constrained in terms of how aggressive they can be in fighting inflation, due to weaker economies and higher debt levels. Real interest rate differentials are a major driver of capital flows, as investors seek to allocate their resources in assets with high, risk-adjusted real yields.

All in all, while the USD may appear overvalued, the outlook remains strong with further upside potential due to geopolitical tensions, a still robust US relative economic performance and more attractive real yields. We expect the USD to remain elevated as other advanced economies are likely to continue to be in a more fragile position.

What's happening in Tunisia?

Subscribe to our Youtube channel for updates.