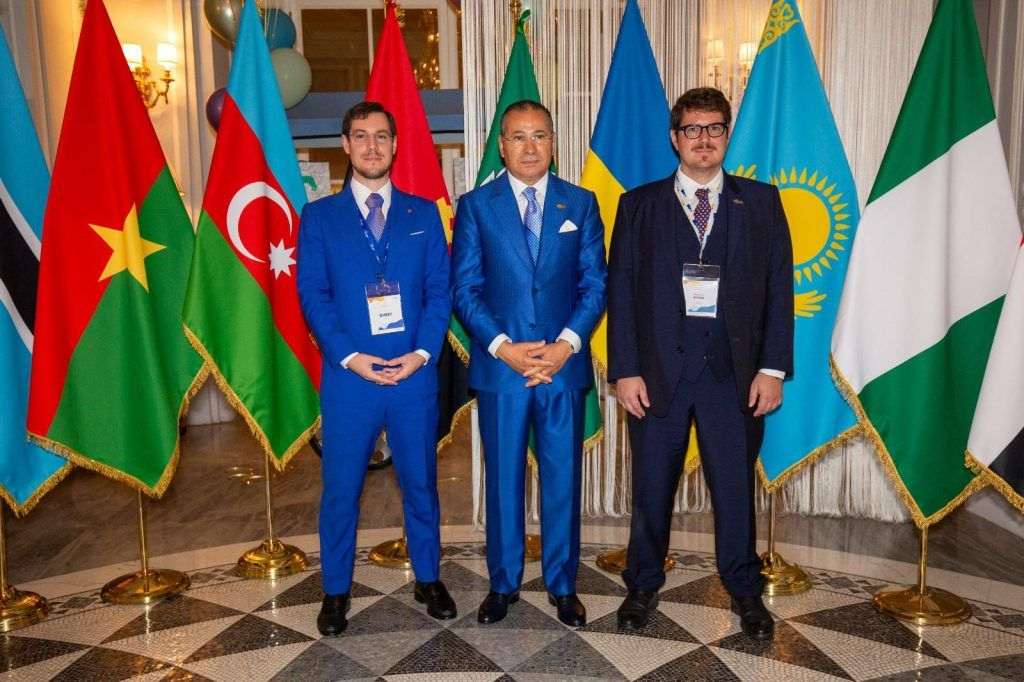

During the 4th Summit on Food Security and Sustainable Health Care, on July 24 in Rome, under the supervision of ECAM (European Business Council for Africa and the Middle East), the participants insisted on the necessity to build bridges across the planet to make health a reality for all. Tunisian investor Kamel Ghribi, Executive Chairman of the Board of ECAM, Chairman of GKSD Investment Holding and of the San Donato Polyclinic, has just laid down concrete milestones in this direction…

His group, San Donato, has disbursed 500 million euros to obtain a majority stake in the Polish cardiovascular care company American Heart of Poland. This operation will permit the Italian group to boost its income and raise the level of the European health sector in view of the next challenges, which are in everyone’s mind after the torment imposed on humanity by the coronavirus pandemic.

After this transaction, the San Donato group’s earnings will increase to 2 billion euros, expressed Masroor Haq, who manages the strategic investments of the investment manager GSKD, San Donato’s partner in this operation. The acquisition will drive the Italian into the circle of European giants for the treatment of cardiovascular diseases.

The aging of the European population coupled with the rise of telemedicine and remote surgery make health one of the niches for investors. The San Donato group, the largest private health structure in Italy with 56 medical sites, could not miss this change. It should be stated that the American Heart of Poland controls more than 20 medical centres specializing in cardiology, cardiosurgery and vascular surgery in the country.

Overall the health sector is in a fine dynamic and weighs 14% in global mergers and acquisitions in the first half of this year. The progress will continue in the second half of 2023, which will make health a key goal for investors, according to the consulting firm PWC.

Last month, the private equity firm Apax gained a majority stake in the Spanish Palex Medical, a medical equipment supplier. Amount of the transaction: 1 billion euros. It is thus a firm trend that will take hold over time and in which world leaders in consulting are mobilized by the major players. The San Donato group and GKSD were recommended by BNP Paribas in this operation, and PwC and Clifford Chance were approached by the shareholders of American Heart of Poland.

What's happening in Tunisia?

Subscribe to our Youtube channel for updates.