International trade is at the centre of the global economy. Its performance provides signals about current economic conditions as well as long-term growth perspectives. After a temporary collapse in global trade volumes in 2020 on the back of the Covid-19 pandemic shock, a strong rebound dissipated concerns that scars on global supply chains could have long-lasting effects on trade. In fact, trade was a significant contributing factor to the post-pandemic global economic recovery. However, 2022 brought a sharp deceleration in trade activity due to a challenging environment of slow growth and high inflation. In our view, there are three factors that will weigh on trade volumes growth going forward.

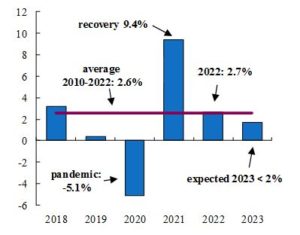

Growth in Volume of Global Trade in Goods

(%, year over year)

Source: World Trade Organization, QNB analysis

First, over the short-term, international trade in goods is undergoing a slowdown due to cyclical dynamics. Measured in volume terms, trade increased 2.7% last year, moderating significantly from the strong post-pandemic boom in 2021. The focus on volumes, rather than values, is relevant given that significant fluctuations in the prices of goods, as were observed during 2022, can distort measurements.

The headwinds were numerous in 2022 and included high commodity prices and inflation eroding real incomes and demand for imports, an overall weakening global economy as well as pandemic-related restrictions in China. Notably, in China, a key player in the international trade system, exports grew 7% in value terms, which was driven by price inflation, while the volume of exports remained practically unchanged.

Going forward, those cyclical factors will continue to weigh on trade growth. Although we expect the monetary tightening cycles by central banks in major economies to come to an end in the coming months, an environment of higher interest rates will add to the slowdown in advanced economies and their demand for imports through tighter financial conditions.

Second, protectionist policies continue to build up at the global level. Across the world, increased protectionism is becoming noticeable in trade policy statistics. The number of trade restrictions on goods has increased from levels below 750 per year before 2019 to over 1,700 per year in 2021 and 2022, on the back of the pandemic and the Russo-Ukrainian conflict. Such politically motivated iniatives impact trade negatively.

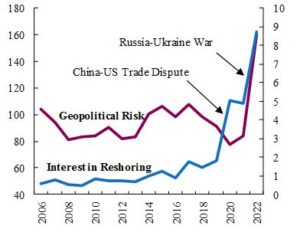

Geopolitical Risk and Corporate Reshoring Interest

(index, frequency of mentions of reshoring in earnings reports)

Source: IMF, QNB analysis

An example of large scale policies implemented by major economies is given by the US, which enacted the “Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act”, as well as the “Inflation Reduction Act”. These programs aim to direct, through tax breaks and subsidies, billions of dollars over the next 10 years to bolster domestic semiconductor manufacturing, R&D, the commercialization of leading-edge technologies as well as clean energy infrastructure. Similarly, Europe and China have put measures in place to replace imported technology with domestic alternatives in order to reduce dependence on geopolitical rivals and strengthen their own competitiveness.

Third, persistent and rising geopolitical tensions are leading to a relocation of global supply chains and are an indicator of trade developments in the future. This is relevant, given that international trade flows are, to a large extent, determined by past investments in production capabilities across countries. Therefore, ongoing developments in foreign direct investment (FDI) are informative about future trends in commerce. Total world FDI has been below 2% of world GDP in the last 3 years, the lowest levels since the 1990s. Furthermore, FDI flows are becoming increasingly driven by “friend-shoring”, rather than being guided by business considerations. Major negative geopolitical events, such as the Chinese-American strategic rivalry and the war in Eastern Europe spark interest of firms in shifting production to new locations with similar geopolitical positions and aspirations. For example, FDI from the US is shifting from China and Vietnam to “friendly” countries, such as Korea and Canada.

A reconfiguration of global supply chain networks based on geopolitical considerations implies a distortion for production from an economic rationale that was focused on profit optimization. This is expected to influence trade developments in the future.

All in all, international trade is set to face pressures from the slowdown in the world economy, protectionist trade policies, and geopolitical tensions. We expect trade growth in volumes to be below 2% this year, and to continue to be weaker than the long-term average over the coming years.

What's happening in Tunisia?

Subscribe to our Youtube channel for updates.