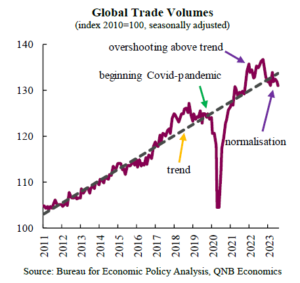

The Covid-pandemic and unprecedented policy stimulus measures boosted manufacturing activity above-trend levels. With lockdowns and social distancing measures, a temporary change in consumer behaviour and spending patterns away from services led to an exceptional global demand for physical goods. By the end of the pandemic, with the normalisation of economic policies and activities, manufacturing began to weaken, and the outlook gradually started to turn gloomy as the demand for services recovered. This was well reflected in the pattern of global trade volumes, which track closely the evolution of manufacturing activity.

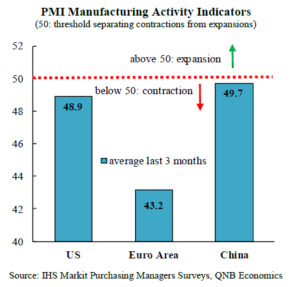

Importantly, manufacturing weakness has been transpiring across all the major economies for several months. The recent data releases show that manufacturing has been contracting in the US, China, and the Euro Area, with particularly negative conditions in the latter, where activity indicators suggest a deep contraction. The Manufacturing Purchasing Managers Indices (PMI) manifest these conditions well. The PMI is a survey-based indicator that provides a measurement of improvement or deterioration in economic activity. An index level of 50 serves as a threshold to separate contractionary (below 50) from expansionary (above 50) business conditions.

In this article, we discuss three main factors that help to explain the ongoing “global manufacturing recession.”

PMI Manufacturing Activity

As previously mentioned, demand imbalances built by unusual consumer behaviour after the pandemic shock led to the recent period of protracted weakness in manufacturing activity. The demand for goods, such as electronics, cars, real estate and home-building equipment was “pulled forward,” as their utility increased during lockdowns. However, the end of the pandemic created a surge in “repressed” service spending, and a re-balancing of the previous consumption trends. Moreover, given the “pulling forward” of the consumption of goods during the pandemic, there is naturally an extensive period of weaker demand.

Furthermore, the supply shock created by the Russo-Ukrainian conflict has been particularly negative for European manufacturing. Lower energy availability at higher prices weigh on industrial competitiveness, particularly of the most exposed countries, such as Germany. In the Euro Area, the latest releases show that industrial production is 4% below its peak of December 2021. In Germany, structural headwinds such as high taxation, labour shortages, and lack of investment in infrastructure have compounded with the energy crisis to create a sharp manufacturing downturn. In fact, industrial production in Germany never recovered to its pre-pandemic levels: it is currently 7.4% below the level of February 2020, and maintains a downward trend that started in 2017.

The economic deceleration of China is weakening its role as a world growth engine, and this is especially relevant for manufacturing. During the four decades of 1980-2019, economic growth in China averaged 9.5% per year, but the pace over the last two years has been much weaker, with growth of 3% last year and around 5.5% expected for this year. The strength of the Chinese economy is important for global manufacturing, given its influence through supply-chain linkages, the appetite for imported commodities, and a growing influence in investment flows across China-influenced emerging markets. Trade linkages with China, for example, are vital for many other emerging markets and especially in Southeast Asia, but also for some advanced economies in Europe, such as Germany, France, and the Netherlands. Given the importance of the Chinese economy, its slowdown implied an important headwind for global manufacturing in recent months.

All in all, global manufacturing has been negatively affected by a rebalancing of consumption away from goods, negative supply shocks in Europe, and the deceleration of the Chinese economy.

What's happening in Tunisia?

Subscribe to our Youtube channel for updates.