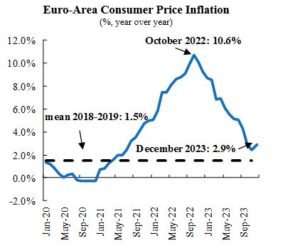

At the beginning of 2020, the outbreak of the Covid-pandemic set in motion a succession of exceptional events that boosted inflation rates to record levels in the Euro-Area in 2022. At the initial stages of the pandemic, lockdowns and supply-chain bottlenecks imposed constraints on supply. Policy responses quickly followed with unprecedented monetary and fiscal stimulus that fuelled demand. Additionally, in 2022, the Russo-Ukrainian war triggered a major commodity shock that was specially negative for Europe, which was heavily dependent on energy imports from Russia. These factors drove the rate of inflation in the Euro-Area to a record peak of 10.6% year-over-year in October of 2022.

Euro-Area Consumer Price Inflation

(%, year over year)

Source: Eurostat, QNB Economics

With inflation rocketing high above the target of monetary policy, the response from the European Central Bank (ECB) followed. The ECB embarked on a record tightening cycle of 10 consecutive rate hikes, increasing its main refinancing rate by 450 basis points to 4.5% in September 2023 to bring inflation down. After reaching its peak in October 2022, inflation began a downward trend with a significant contribution from declining energy prices and the normalization of supply-chain conditions. Inflation came at 2.9% in the latest release, down by close to 8 percentage points (p.p.) in a year, and now standing less than 1 percentage point away from the 2% target of the ECB.

In our view, given the significant progress and the steady trend in declining inflation, it is likely that the ECB will “pivot”, or start cutting policy rates, in the coming months. In this article, we discuss the two main factors that support our view.

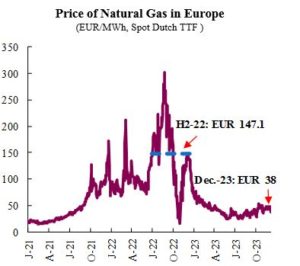

First, the significant declines in the prices of energy, including oil at the international level and natural gas in the European market, continue to help to bring inflation down. Both oil and natural gas have a direct impact on prices faced by consumers, but also indirectly through lower costs of production for firms. The Brent oil price peaked at an average of USD 124 per barrel (p/b) in June of 2022, and has since then fallen to the range of USD 75-80 p/b. The fall of European natural gas prices is even more striking: from an average of EUR 147.1 per MWh in H2-2022 to EUR 38 per MWh in December 2023. The direct impact of overall energy costs implied almost 2 p.p. less of inflation faced by consumers in November.

Price of Natural Gas in Europe

(EUR/MWh, Spot Dutch TTF )

Source: Bloomberg, QNB Economics

Additionally, lower energy costs transmit indirectly to consumer prices through lower costs of production, where the impact is even more remarkable and will take time to fully materialize. According to the Producer Price Index (PPI), which is a gauge of prices paid to producers of goods and services, prices are falling at an average rate of 10% year-over-year in the last 3 months. With a lower likelihood of an energy crisis similar to that of 2022, in addition to the direct impact on prices paid by consumers, lower production costs will further contribute to the declining trend in overall inflation.

Second, softening labor markets amid a stagnating economy will reduce wage cost pressures for firms, and therefore inflation. Unemployment rates in the Euro-Area have stabilized at an average 6.5% in the last 3 months, which is the lowest since the beginning of the series in 2000. But after a strong post-pandemic recovery, the economy has remained stagnant throughout 2023, with a contraction of GDP in Q3-2023 of 0.1%, and a similar negative figure expected for Q4-2023. These contractions would leave the economy in a recession, defined as two consecutive quarters of negative growth.

Additionally, current policy rates are tight according to the real “neutral” interest rate benchmark, which determines the level above which interest rates are restrictive for the economy. The real “neutral” rate is defined as the nominal interest rate minus inflation that is consistent with an economy in equilibrium. The estimates for the Euro-Area put the real neutral rate at close to 0%. In contrast, the current nominal policy rate of 4.5% minus inflation of 2.9% implies a real interest rate of approximately 1.6%. Therefore, the current level of the real interest rate of 1.6% is significantly above the real neutral interest rate. This means that the policy rate is high, deeply in restrictive territory and placing undue downward pressure on the economy. Furthermore, the policy rate is automatically becoming tighter as inflation goes down, even if the ECB is not putting into effect additional rate hikes. As a result of the weak economy and tight financial conditions, there are signs of easing in the labor markets, such as a deceleration in wage growth, which will further support the decline in inflation.

All in all, inflation has come down significantly from its peak in the Euro-Area, and is converging to the desired target of 2% due to the normalization of energy prices and a stagnating economy. In our view, these developments open the door to interest rate cuts in the coming months.

What's happening in Tunisia?

Subscribe to our Youtube channel for updates.