The European Central bank raised its policy interest rates once again in June, reaffirming its most aggressive tightening cycle on record in its efforts to return inflation to the target of 2% over the medium term. Since the beginning of the cycle in July 2022, the policy rates have accumulated increases of 400 bps, taking the main refinancing operations rate to 4.00%, the highest since 2008. Although the upcoming decisions are expected to be more “balanced” and dependent on incoming data, the Governing Council has given signals that additional hikes are likely on the way, before it turns to a “wait and see” mode to assess the impact of the tightening cycle on the economy.

In this commentary, we analyze three key factors behind the latest ECB decision, and the signals for potential additional hikes in the upcoming meetings.

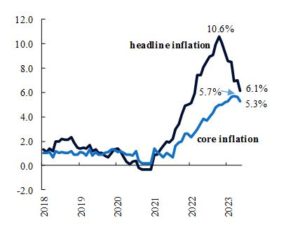

Inflation in the Euro Area

(%, year over year)

Source: Eurostat, QNB Economics

First, despite a significant reduction in headline inflation from the peak reached in October last year, core inflation remains too high and persistent. Core inflation puts aside prices related to commodities, which are driven by external global factors rather than domestic developments. The behaviour of core inflation is particularly relevant for monetary policy because it reflects the effects of previous decisions, and provides signals that interest rate hikes are having a fundamental effect on price growth.

Headline inflation reached a peak of 10.6% in October of 2022 and has, since then, fallen by 4.5 percentage points (p.p.) to 6.1% in May this year. This is a substantial improvement but, as we discussed in a previous commentary, it was largely explained by the drop in energy prices, which have become more stable recently, and have more limited margin to contribute to the fall in overall price growth. Core inflation, which excludes more volatile items such as energy and food products, has only fallen by 0.4 p.p. since the peak reached in March this year. This persistence has led the ECB to revise upwards their projections for core inflation, which is now seen reaching 5.1% in 2023, implying an increase of half a percentage point relative to the previous forecast published in March.

Additionally, for the ECB it is not sufficient to see that inflation is coming down. The central bank has stressed that policy rates should be brought to levels that are sufficiently restrictive so as to ensure that inflation returns to its 2% medium term target in a “timely manner.”

Unit Labor Costs in the Euro Area

(% quarterly, year over year)

Source: OECD, QNB Economics

Second, tight labor markets continue to raise labor costs and generate inflation pressures. The unemployment rate continued to fall since the beginning of the year and hit 6.5% in April, reaching a new historical minimum. In line with these tight conditions, growth in unit labor costs reached an alarming rate of 5.8% in Q1-2023, significantly above the 1.2% pre-Pandemic average of 2015-2019. This reinforces the upward trend in labor costs, and adds more cause for concern.

Going forward, tight labor markets together with increases in minimum wages are expected to fuel wage growth, which will remain over double its historical average for most of their projection period. This implies labor costs will remain a dominant driver of core inflation, which points to an additional argument for the ECB to continue tightening interest rates.

Third, although the economy has slowed down, the ECB expects activity to strengthen, and has stressed the resilience of the economy against recent large negative shocks. The central bank expects growth in activity to pick up and remain “solid” in the second half of the year, as the impact of supply bottlenecks and energy shocks wanes, and real income recovers with wages growing faster than headline inflation. On the back of these factors, the ECB forecasts GDP will grow 0.9% this year, before it accelerates to 1.5% in 2024. Given the resilience in the economy, and absent a major economic downturn in the horizon, the balance favors additional hikes in upcoming decisions.

All in all, the ECB has based its last policy interest rate hike on the persistence of core inflation, ongoing labor cost pressures, and a resilient economy, while signalling that further rate hikes are likely, before a pause that takes into account the lags in the effects of monetary policy.

What's happening in Tunisia?

Subscribe to our Youtube channel for updates.