Tunis Survey, a leading expert in online surveys and digital studies, has just released the results of an inquiry relating to “Tunisian and his bank”.

This study is based on a self-administered online survey which took place from 17 to 24 June 2020 with the participation of 3285 interviewees.

On a self-reporting basis, respondents were essentially invited to:

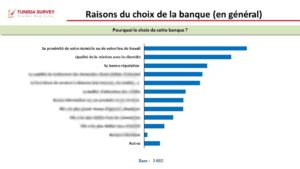

- Identify the reasons for selecting their main bank:

- To communicate their level of satisfaction and dissatisfaction in comparison to their main bank as well as to identify the factors of satisfaction or dissatisfaction.

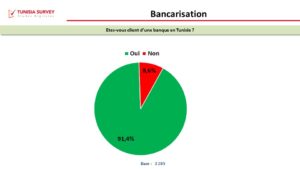

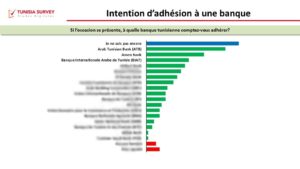

The survey takes into account 2 types of respondents. Indeed, the main filter question permits, at the commencement of the questionnaire, to recognise whether the respondent is already a customer of a bank or not. And in the second sample, which Tunisian bank does he plan to join.

The survey involved 19 banks with the possibility for the respondent to attach a bank not appearing in the list of suggestions.

A difficult relationship with his bank:

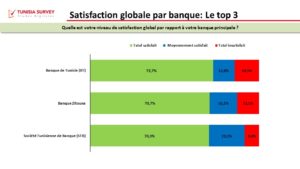

91.4% of respondents are bank customers. Over 42.3% of them are moderately satisfied to Not at all satisfied.

Banque de Tunisie, STB and Banque Zitouna are the banks with the most fully satisfied customers.

For those who are not bank customers, 17% still do not know which bank they intend to join if the occasion arises.

- Its proximity to the home or the workplace (28.9%).

- Its good reputation (27.7%).

- The quality of customer relations (26.8%).

The specific reasons for the choice of each bank are revealed in the full study report.

For bank customers:

For bank customers as well as for clients that not yet banked, the same primary reasons for selecting the main bank have been put forth, to varying degrees of significance:

- Its proximity to the home or the workplace (47.8%);

- Its good reputation (40.5%); The quality of customer relations (29.3%)

- Proximity to home or workplace & the quality of the relationship with customers are two decisive grounds for the choice of the main bank for 18 of the 19 banks examined.

Respondents are more connected and favour to interface with their banks using digital channels. For this purpose, 41.5% of respondents use e-banking (ATM / ATM, via the Mobile application, via the web service: online banking and customer area and or by phone).

Only 23% of respondents solely prefer to move to the bank. Online banking is gaining ground and the digitalization of banking is increasingly becoming an imperative.

The detailed reasons for choosing each main bank and the channels used by respondents are shown in the full study report.

Reasons for dissatisfaction:

1 in 5 bank customers maintains they are dissatisfied with their bank.

The 4 most common reasons for dissatisfaction with the subject “Why are you not satisfied with your main bank?” Were the following:

- High commission payments (51.6%).

- Delayed processing of customer demands (42.8%).

- Inadequate customer relations (41.5%).

- Poor quality of remote services (38.9%).

The study also observed the reasons for dissatisfaction specific to each bank.

The full analysis can be requested at www.tunisia-survey.com.

What's happening in Tunisia?

Subscribe to our Youtube channel for updates.