The Covid-pandemic resulted in long-lasting macroeconomic repercussions that are felt to this day. As confinement measures restricted production activity and brought a deep economic collapse, unprecedented monetary and fiscal stimulus was put into action to support households and firms. Additionally, the Russo-Ukrainian war that started in 2022 triggered a major commodity shock that fuelled prices of energy and food. These factors drove inflation rates to multi-decade highs across the globe. As a response, most major central banks, such as the U.S. Federal Reserve Board (“the Fed”), the European Central Bank (ECB), and the Bank of England, embarked on aggressive monetary policy tightening cycles to control inflation.

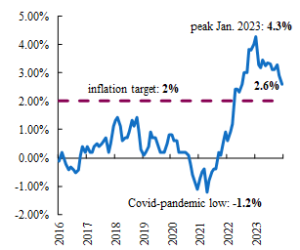

Consumer Price Inflation in Japan

(%, year-over-year)

Source: Haver Analytics, Bank of Japan, QNB Economics

In stark contrast to its peers in other advanced economies, the Bank of Japan (BoJ) followed a different path of monetary policy, and kept its negative short-term interest rate of -0.1% unchanged. This “ultra-loose” monetary stance, compared to the aggressive tightening by the Fed and the ECB, led to a depreciation of over 40% of the Japanese Yen (JPY) against the U.S. dollar at the point of maximum pressure in October 2022. The sharp depreciation of the JPY added to the impact of global supply shocks caused by the pandemic to push Japanese consumer price inflation to a peak of 4.3% year-over-year in January 2023, a level that had not been reached in this country in over 3 decades.

In spite of the high rates of inflation, the Bank of Japan still stands as a notable exception to the recent trend of interest rate tightening of other central banks in advanced economies. There are compelling reasons for the BoJ to be more cautious, having experienced below-target inflation for decades and even suffered from years of deflation. By the end of 2023, there were growing expectations that the BoJ was getting ready to begin a gradual process of normalisation of its monetary policy stance. However, these expectations were once again revised, given the evolving macroeconomic outlook and the earthquake that hit Japan on New Year’s Day. In this article, we discuss the key factors that explain why the BoJ will continue to delay its monetary policy normalisation process.

First, the sustained fall in inflation rates has re-ignited fears that Japan could return to a lasting scenario with inflation meaningfully below target. After reaching the peak of 4.3% at the beginning of 2023, inflation began to drop sharply as the impact of the Yen depreciation faded, reaching 2.6% in the latest data print for December last year.

Additionally, the labour market is signalling decreasing cost pressures, adding cause for concern. Wages increased by merely 0.2% in November 2023, relative to the same month in the previous year. The ratio of available jobs to applicants, a useful measure of the abundance of work opportunities, shows decreasing tightness in labour markets. This ratio has fallen throughout 2023, anticipating that cost pressures from wages continue to weaken, while the overall inflation rate is expected to fall below the 2% target by the end of the year. These trends give the BoJ an important reason for caution in modifying its monetary policy stance.

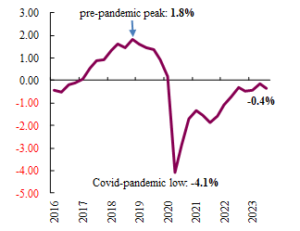

Second, despite a substantial recovery from the low during the Covid-pandemic, overall demand remains below the long-run production capacity of the economy. The Bank of Japan uses capital and labour data to construct the “output gap” statistic, which measures the level of demand relative to the production possibilities of the economy. This measure is closely monitored by the BoJ, given that sustained negative output gaps warn of potential deflationary pressures. During the Covid-pandemic, the output gap collapsed to a low of -4.1%, foreseeing the drop in inflation to the negative territory. After 14 consecutive quarters in the negative range, demand had still not fully recovered as of the latest release of Q3-2023, when it was still 0.4% below production capacity. The earthquake that hit Japan on New Year’s Day added to concerns, amid leading indicators that point to further softening in economic activity. Thus, the overall outlook for Japan’s economic growth remains bleak, giving the BoJ another argument for delaying a policy interest rate increase change.

All in all, given the outlook of falling inflation and weak economic activity going forward, the BoJ will remain highly cautious in its next decisions. In our view, an increase of the policy interest rate of only 10 basis points to 0% is likely for the next meeting in April, while the next decisions will be highly dependent on incoming data.

Output Gap of Japan

04

04

(% of potential GDP)

Source: Bank of Japan, QNB Economics

What's happening in Tunisia?

Subscribe to our Youtube channel for updates.